The Future of Urban Living: Why Co-Living Spaces Are on the Rise in 2025

Jun 2, 2025

By

Nuvarsa

,

Published on

Jun 2, 2025

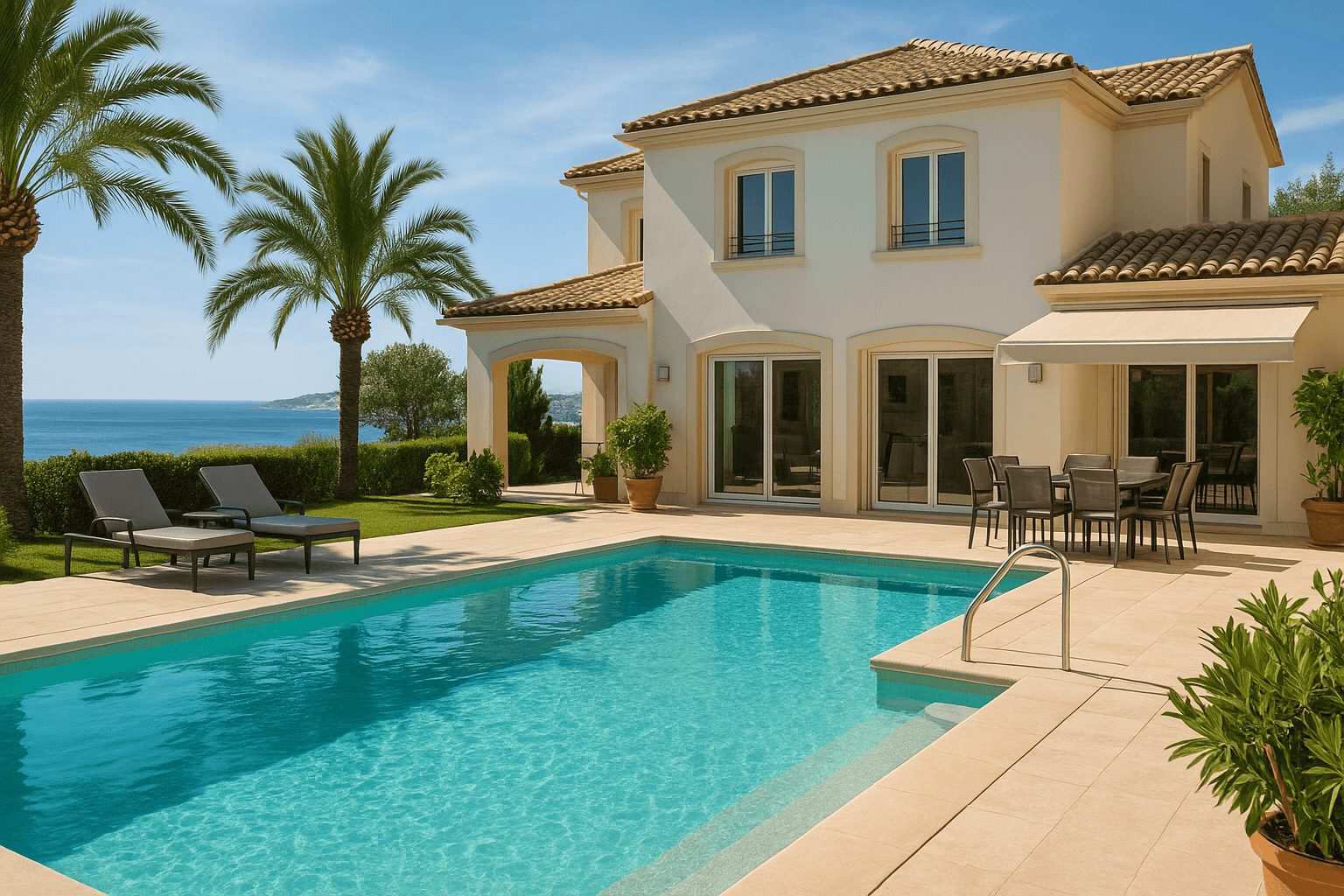

In 2025, the travel industry is roaring back—stronger, more flexible, and more digitally connected than ever. As a result, vacation rental properties have become one of the most lucrative real estate segments, offering a blend of lifestyle, flexibility, and financial gain.

What used to be a side hustle for a few is now a strategic, full-time investment opportunity. Platforms like Airbnb, Vrbo, and Booking.com have made it easier than ever to manage short-term rentals across the globe—even remotely.

One of the biggest appeals of owning a vacation rental is that it serves two roles:

A personal retreat for holidays, remote work, or family time.

A money-making asset when you’re not using it.

This hybrid use is what makes it both emotionally and financially rewarding.

Compared to long-term rentals, vacation properties can generate 2–3x more income in high-demand seasons. With dynamic pricing tools, hosts can adjust rates based on occupancy, events, or tourism trends to maximize returns.

You’re no longer limited to your local area. Investors now buy properties in international hotspots like Bali, Lisbon, or Tulum with local management teams handling everything from cleaning to check-ins.

The success of your vacation rental depends heavily on where you buy. Ideal locations include:

Tourist hotspots with year-round appeal (beaches, ski towns, cultural cities)

Places with low seasonality risk

Areas with business and digital nomad travel

Locations with favorable short-term rental regulations

Use tools like AirDNA or Mashvisor to analyze occupancy rates and average daily income in specific zip codes.

High-Speed Internet: Essential for remote workers and digital nomads.

Stylish Interior Design: First impressions from photos matter.

Self-Check-In Options: Keyless entry systems improve guest experience.

Pet-Friendly Policies: A growing number of travelers bring pets.

Hot Tubs / Pools / Unique Features: Add luxury or local charm.

Before diving in, be aware of:

Short-Term Rental Regulations: Some cities limit how many days you can rent out a property.

Property Management Fees: Outsourcing cleaning and guest communication typically costs 20–30% of your rental income.

Insurance Needs: You’ll need a special policy that covers short-term rentals.

Maintenance Budget: High guest turnover means higher wear and tear.

Automate Everything: Use tools for messaging, pricing, and calendar syncing.

Professional Photography: Better photos = higher click-through rates.

Optimize Listing Descriptions: Highlight unique amenities, walkability, and local attractions.

Encourage Reviews: Social proof is critical in this space.

Vacation rentals aren't just about profit—they're about creating memorable experiences. In the right market, a well-managed property can cover its mortgage, generate surplus cash flow, and increase in value—all while giving you a beautiful escape whenever you need it.

For 2025 and beyond, vacation rentals remain one of the most exciting and flexible real estate opportunities for savvy investors.